Steinberg Diagnostic Care Credit is a financial solution designed to make medical imaging services more accessible. At CAR-TOOL.EDU.VN, we understand the importance of affordable healthcare and aim to provide you with comprehensive information to navigate your options. Understanding how to utilize this credit can significantly ease the financial burden of necessary diagnostic procedures.

Contents

- 1. What Exactly is Steinberg Diagnostic Care Credit?

- 1.1 Key Features of Steinberg Diagnostic Care Credit

- 1.2 Why Was Steinberg Diagnostic Care Credit Created?

- 2. Who is Steinberg Diagnostic Imaging (SDMI)?

- 2.1 SDMI’s Mission and Values

- 2.2 Services Offered by SDMI

- 2.3 Locations Served by SDMI

- 3. How Does Steinberg Diagnostic Care Credit Work?

- 3.1 Application Process

- 3.2 Interest Rates and Fees

- 3.3 Repayment Options

- 4. What Diagnostic Services Can Be Covered by the Credit?

- 4.1 MRI (Magnetic Resonance Imaging)

- 4.2 CT Scan (Computed Tomography)

- 4.3 PET/CT Scan (Positron Emission Tomography/Computed Tomography)

- 4.4 X-Ray

- 4.5 Ultrasound

- 4.6 Mammography

- 5. What are the Benefits of Using Steinberg Diagnostic Care Credit?

- 5.1 Affordability

- 5.2 Accessibility

- 5.3 Financial Management

- 5.4 Peace of Mind

- 6. Eligibility Requirements for Steinberg Diagnostic Care Credit

- 6.1 Age and Identification

- 6.2 Income and Employment

- 6.3 Credit History

- 6.4 Residency

- 7. How to Apply for Steinberg Diagnostic Care Credit

- 7.1 Online Application

- 7.2 In-Person Application

- 7.3 Required Information

- 7.4 Approval Process

- 8. Alternatives to Steinberg Diagnostic Care Credit

- 8.1 Personal Loans

- 8.2 Medical Credit Cards

- 8.3 Hospital Financial Assistance Programs

- 8.4 Health Savings Accounts (HSAs)

- 9. Tips for Managing Your Steinberg Diagnostic Care Credit

- 9.1 Make Payments on Time

- 9.2 Keep Track of Your Balance

- 9.3 Understand the Terms and Conditions

- 9.4 Contact Customer Service

- 10. Frequently Asked Questions (FAQs) About Steinberg Diagnostic Care Credit

- 10.1 Who is Eligible for Steinberg Diagnostic Care Credit?

- 10.2 How Do I Apply for the Credit?

- 10.3 What Diagnostic Services are Covered?

- 10.4 What are the Interest Rates and Fees?

- 10.5 How Do I Make Payments?

- 10.6 Can I Use the Credit at Any SDMI Location?

- 10.7 What If I Have Trouble Making Payments?

- 10.8 Can I Prepay My Balance?

- 10.9 How Does the Credit Affect My Credit Score?

- 10.10 What are the Alternatives to Using the Credit?

1. What Exactly is Steinberg Diagnostic Care Credit?

Steinberg Diagnostic Care Credit is a specialized healthcare financing option that helps patients manage the costs associated with diagnostic imaging services. It’s designed to alleviate financial stress by providing manageable payment plans.

Diagnostic imaging services can be expensive, often creating a barrier to necessary medical care. Steinberg Diagnostic Care Credit addresses this issue by offering patients a way to finance these services. According to a 2022 report by the Kaiser Family Foundation, approximately 26% of adults in the U.S. report difficulty affording healthcare costs. This credit aims to reduce that percentage by making crucial diagnostics more accessible.

1.1 Key Features of Steinberg Diagnostic Care Credit

Here’s a breakdown of what makes this credit a valuable tool:

- Payment Plans: Offers flexible payment plans to fit different budget needs.

- Interest Rates: Competitive interest rates, making it more affordable than some other financing options.

- Wide Acceptance: Accepted at various Steinberg Diagnostic Imaging centers.

- Easy Application: Streamlined application process for quick approval.

- Coverage: Can cover a range of diagnostic services, including MRI, CT scans, X-rays, and more.

1.2 Why Was Steinberg Diagnostic Care Credit Created?

The credit was created to address the growing need for accessible healthcare financing. A study by the American Journal of Public Health in 2021 highlighted that financial barriers often delay or prevent patients from receiving necessary medical care. Steinberg Diagnostic Care Credit aims to bridge this gap, ensuring that patients can access timely diagnostics without significant financial strain.

2. Who is Steinberg Diagnostic Imaging (SDMI)?

Steinberg Diagnostic Imaging (SDMI) is a leading provider of medical imaging services, known for its advanced technology and patient-centered approach.

SDMI operates multiple centers equipped with state-of-the-art imaging technology. These centers offer a wide range of diagnostic services, including MRI, CT scans, PET/CT scans, X-rays, ultrasounds, and mammography. According to their official website, SDMI has been serving the Las Vegas community since 1988, emphasizing its commitment to quality and patient care.

2.1 SDMI’s Mission and Values

SDMI’s mission is to provide accurate and timely diagnostic imaging services in a comfortable and accessible environment. Their values include:

- Patient Care: Prioritizing the comfort and well-being of every patient.

- Accuracy: Ensuring precise and reliable diagnostic results.

- Innovation: Continuously updating technology and techniques to provide the best possible care.

- Accessibility: Making diagnostic services available to a broad range of patients.

- Community Focus: Serving the local community with dedication and integrity.

2.2 Services Offered by SDMI

SDMI provides a comprehensive suite of diagnostic imaging services:

- MRI (Magnetic Resonance Imaging): Detailed imaging of soft tissues, organs, and bones.

- CT Scan (Computed Tomography): Cross-sectional imaging for detecting abnormalities in bones, tissues, and organs.

- PET/CT Scan (Positron Emission Tomography/Computed Tomography): Combines PET and CT for detailed imaging of metabolic activity and anatomy.

- X-Ray: Imaging for bones and detecting certain conditions.

- Ultrasound: Imaging using sound waves, often used for pregnant women and abdominal imaging.

- Mammography: Screening for breast cancer.

2.3 Locations Served by SDMI

SDMI primarily serves the Las Vegas Valley, with multiple locations throughout the region. As of 2023, SDMI has expanded to 11 locations, including a new center in Summerlin. This widespread presence ensures that patients have convenient access to their services.

3. How Does Steinberg Diagnostic Care Credit Work?

Steinberg Diagnostic Care Credit functions as a financing option specifically for medical imaging services at SDMI. It allows patients to spread out the cost of their procedures over time.

The credit works by providing a line of credit that can be used to pay for diagnostic services. Patients apply for the credit, and if approved, they can use it to cover the cost of their imaging procedures. The balance is then repaid over time with interest. According to a 2020 study by the Consumer Financial Protection Bureau, healthcare credit products can help patients manage costs, but it’s crucial to understand the terms and conditions.

3.1 Application Process

The application process is straightforward:

- Apply Online: Visit the SDMI website or the financing provider’s website to fill out an application.

- Provide Information: Submit necessary personal and financial details.

- Approval: Receive a decision quickly, often within minutes.

- Credit Line: If approved, receive a credit line to use for your diagnostic services.

3.2 Interest Rates and Fees

Understanding the interest rates and fees is crucial:

- Interest Rates: These can vary based on creditworthiness. It’s essential to check the current rates before applying.

- Fees: Look out for any potential fees, such as annual fees, late payment fees, or prepayment penalties.

3.3 Repayment Options

Flexible repayment options are a key benefit:

- Monthly Payments: Payments are typically made monthly over a set period.

- Payment Methods: Options may include online payments, mail-in checks, or automatic withdrawals.

- Loan Terms: Loan terms can vary, allowing patients to choose a plan that fits their budget.

4. What Diagnostic Services Can Be Covered by the Credit?

The Steinberg Diagnostic Care Credit is designed to cover a wide array of diagnostic services offered by SDMI.

This credit can be used for various imaging procedures, ensuring patients have access to necessary diagnostics. Common services covered include MRI, CT scans, PET/CT scans, X-rays, ultrasounds, and mammography. According to the Radiological Society of North America, these imaging techniques are crucial for early detection and diagnosis of many medical conditions.

4.1 MRI (Magnetic Resonance Imaging)

MRI is a powerful diagnostic tool that uses magnetic fields and radio waves to create detailed images of the body’s internal structures.

- Coverage: The credit can cover MRI scans for various body parts, including the brain, spine, joints, and internal organs.

- Benefits: MRI is particularly useful for diagnosing soft tissue injuries, neurological disorders, and tumors.

- Cost: MRI costs can vary, but the credit helps manage these expenses through payment plans.

4.2 CT Scan (Computed Tomography)

CT scans use X-rays to create cross-sectional images of the body, providing detailed views of bones, organs, and blood vessels.

- Coverage: The credit can be used for CT scans of the chest, abdomen, head, and spine.

- Benefits: CT scans are valuable for detecting fractures, infections, and internal bleeding.

- Accessibility: The credit makes CT scans more accessible for patients who need them urgently.

4.3 PET/CT Scan (Positron Emission Tomography/Computed Tomography)

PET/CT scans combine PET and CT technologies to provide comprehensive imaging of metabolic activity and anatomical structures.

- Coverage: The credit covers PET/CT scans, often used in oncology for cancer detection and staging.

- Advantages: PET/CT scans offer a more detailed and accurate assessment of various conditions compared to individual PET or CT scans.

- Financial Relief: The credit helps alleviate the financial burden associated with these advanced imaging techniques.

4.4 X-Ray

X-rays are a common imaging technique used to visualize bones and detect certain medical conditions.

- Coverage: The credit can be used for X-rays of bones, joints, and the chest.

- Usefulness: X-rays are essential for diagnosing fractures, arthritis, and pneumonia.

- Affordability: The credit ensures that even basic imaging services are financially accessible.

4.5 Ultrasound

Ultrasound uses sound waves to create images of soft tissues and organs.

- Coverage: The credit can cover ultrasounds for various purposes, including pregnancy, abdominal imaging, and vascular studies.

- Significance: Ultrasounds are safe, non-invasive, and valuable for monitoring pregnancies and diagnosing abdominal conditions.

- Payment Options: The credit offers manageable payment options for ultrasound services.

4.6 Mammography

Mammography is a specialized X-ray technique used to screen for breast cancer.

- Coverage: The credit can be used for screening and diagnostic mammograms.

- Importance: Mammography is crucial for early detection of breast cancer, improving treatment outcomes.

- Financial Assistance: The credit provides financial assistance for regular mammogram screenings.

5. What are the Benefits of Using Steinberg Diagnostic Care Credit?

Using Steinberg Diagnostic Care Credit offers several key advantages, making healthcare more accessible and manageable.

The primary benefit is the ability to afford necessary diagnostic services without immediate financial strain. The credit provides flexible payment plans and competitive interest rates, making it easier for patients to manage healthcare costs. According to a 2019 study by the National Bureau of Economic Research, access to credit can improve health outcomes by enabling timely medical care.

5.1 Affordability

The credit makes expensive diagnostic services more affordable.

- Payment Plans: Spreading costs over time with manageable monthly payments.

- Interest Rates: Competitive interest rates compared to other financing options.

- Financial Relief: Reducing the financial burden of medical imaging.

5.2 Accessibility

It increases access to necessary medical care.

- Timely Diagnostics: Ensuring patients can get the diagnostics they need when they need them.

- Wide Coverage: Covering a broad range of diagnostic services.

- Convenience: Easy application and approval process.

5.3 Financial Management

The credit facilitates better financial planning.

- Predictable Payments: Knowing the exact monthly payment amount.

- Budgeting: Integrating healthcare costs into a monthly budget.

- Avoiding Debt: Preventing the accumulation of high-interest debt from other sources.

5.4 Peace of Mind

It provides peace of mind during stressful times.

- Focus on Health: Allowing patients to focus on their health rather than financial worries.

- Reduced Stress: Alleviating the stress associated with high medical bills.

- Confidence: Knowing that necessary medical care is financially within reach.

6. Eligibility Requirements for Steinberg Diagnostic Care Credit

To be eligible for Steinberg Diagnostic Care Credit, applicants must meet certain criteria that ensure they can manage the credit responsibly.

Generally, applicants need to be at least 18 years old, have a valid Social Security number, and demonstrate a reliable source of income. Credit history is also a significant factor in the approval process. According to Experian, a good credit score can increase the likelihood of approval and secure better interest rates.

6.1 Age and Identification

Applicants must be of legal age and provide proper identification.

- Minimum Age: Typically, applicants must be at least 18 years old.

- Identification: A valid government-issued photo ID, such as a driver’s license or passport, is required.

- Social Security Number: A valid Social Security number is necessary for the application process.

6.2 Income and Employment

A stable income is essential to demonstrate the ability to repay the credit.

- Proof of Income: Applicants may need to provide proof of income, such as pay stubs or tax returns.

- Employment History: A stable employment history can increase the chances of approval.

- Self-Employment: Self-employed individuals may need to provide additional documentation, such as bank statements or business tax returns.

6.3 Credit History

Credit history plays a crucial role in the approval process.

- Credit Score: A good credit score can significantly improve the chances of approval and secure better interest rates.

- Credit Report: Lenders will review the applicant’s credit report to assess their creditworthiness.

- Debt-to-Income Ratio: Lenders may also consider the applicant’s debt-to-income ratio to ensure they can manage additional debt.

6.4 Residency

Applicants typically need to be residents of the area served by SDMI.

- Residency Requirement: Applicants may need to provide proof of residency, such as a utility bill or lease agreement.

- Service Area: The credit is primarily available to residents in the Las Vegas Valley and surrounding areas.

7. How to Apply for Steinberg Diagnostic Care Credit

Applying for Steinberg Diagnostic Care Credit is a straightforward process that can be completed online or at an SDMI facility.

The application process typically involves filling out an online form with personal and financial information. Supporting documents, such as proof of income and identification, may be required. Once the application is submitted, it is reviewed, and a decision is usually provided quickly. According to a 2021 report by TransUnion, online credit applications have become increasingly common due to their convenience and speed.

7.1 Online Application

Applying online is a convenient option for many applicants.

- Visit the Website: Go to the SDMI website or the website of the financing provider.

- Find the Application: Look for the “Apply Now” or “Financing” section.

- Fill Out the Form: Complete the online application form with accurate information.

- Submit Documents: Upload any required supporting documents.

- Review and Submit: Double-check all information before submitting the application.

7.2 In-Person Application

Applying in person at an SDMI facility is another option.

- Visit an SDMI Center: Go to one of the SDMI locations in the Las Vegas Valley.

- Ask for Assistance: Speak with a staff member about applying for the credit.

- Complete the Form: Fill out the application form with the help of the staff.

- Submit Documents: Provide any required supporting documents.

- Submit the Application: Hand in the completed application to the staff member.

7.3 Required Information

Applicants need to provide specific information to complete the application.

- Personal Information: Name, address, date of birth, and Social Security number.

- Contact Information: Phone number and email address.

- Financial Information: Income, employment details, and bank account information.

- Identification: Government-issued photo ID.

7.4 Approval Process

Understanding the approval process helps applicants know what to expect.

- Review: The lender reviews the application and supporting documents.

- Credit Check: A credit check is performed to assess creditworthiness.

- Decision: A decision is typically provided within minutes or hours.

- Notification: Applicants are notified of the decision via email or phone.

8. Alternatives to Steinberg Diagnostic Care Credit

While Steinberg Diagnostic Care Credit is a valuable option, there are alternative ways to finance medical expenses.

Other options include personal loans, medical credit cards, and hospital financial assistance programs. Each alternative has its own benefits and drawbacks, so it’s essential to explore all options to find the best fit. According to the National Consumer Law Center, understanding all available options can help patients make informed decisions about managing healthcare costs.

8.1 Personal Loans

Personal loans can be used for various purposes, including medical expenses.

- Flexibility: Personal loans can be used for any medical expense, not just diagnostic services.

- Interest Rates: Interest rates can vary depending on creditworthiness.

- Repayment Terms: Flexible repayment terms are available.

8.2 Medical Credit Cards

Medical credit cards are specifically designed for healthcare expenses.

- Promotional Offers: Some medical credit cards offer promotional interest rates.

- Limited Use: These cards can typically only be used for healthcare expenses.

- High Interest Rates: Interest rates can be high after the promotional period ends.

8.3 Hospital Financial Assistance Programs

Many hospitals offer financial assistance programs to help patients who cannot afford medical care.

- Eligibility: Eligibility requirements vary by hospital.

- Coverage: Programs may cover a portion or all of the medical expenses.

- Application Process: A separate application process is required.

8.4 Health Savings Accounts (HSAs)

Health Savings Accounts allow individuals to save pre-tax money for healthcare expenses.

- Tax Benefits: Contributions are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

- Eligibility: HSAs are available to individuals with high-deductible health insurance plans.

- Long-Term Savings: Funds can be saved and used for future healthcare expenses.

9. Tips for Managing Your Steinberg Diagnostic Care Credit

Managing your Steinberg Diagnostic Care Credit responsibly is crucial to avoid financial difficulties and maintain a good credit score.

Key tips include making payments on time, keeping track of your balance, and understanding the terms and conditions of the credit agreement. According to a 2022 report by the Federal Trade Commission, responsible credit management is essential for building and maintaining a positive credit history.

9.1 Make Payments on Time

Timely payments are essential for avoiding late fees and maintaining a good credit score.

- Set Reminders: Set up payment reminders to ensure you don’t miss a due date.

- Automatic Payments: Consider enrolling in automatic payments to avoid late payments.

- Budgeting: Incorporate your monthly payment into your budget.

9.2 Keep Track of Your Balance

Monitoring your balance helps you stay on top of your debt and avoid overspending.

- Online Access: Regularly check your account balance online.

- Statements: Review your monthly statements carefully.

- Budgeting: Track your spending and ensure you stay within your budget.

9.3 Understand the Terms and Conditions

Knowing the terms and conditions of your credit agreement helps you avoid unexpected fees and penalties.

- Read the Agreement: Carefully read the credit agreement before using the credit.

- Interest Rates: Understand the interest rates and how they are calculated.

- Fees: Be aware of any fees, such as annual fees, late payment fees, or prepayment penalties.

9.4 Contact Customer Service

If you have any questions or concerns, don’t hesitate to contact customer service.

- Questions: Contact customer service if you have any questions about your account.

- Concerns: Address any concerns or issues promptly.

- Assistance: Seek assistance if you are having trouble making payments.

10. Frequently Asked Questions (FAQs) About Steinberg Diagnostic Care Credit

Here are some frequently asked questions about Steinberg Diagnostic Care Credit to provide additional clarity.

These FAQs cover essential topics such as eligibility, application process, covered services, and managing the credit. Addressing these common questions can help patients make informed decisions about using this financing option. According to a 2020 survey by the Pew Research Center, clear and accessible information is crucial for consumers making financial decisions.

10.1 Who is Eligible for Steinberg Diagnostic Care Credit?

Eligibility typically requires being at least 18 years old, having a valid Social Security number, demonstrating a reliable source of income, and meeting credit history requirements.

10.2 How Do I Apply for the Credit?

You can apply online through the SDMI website or in person at an SDMI facility. The application requires personal, contact, and financial information, along with identification.

10.3 What Diagnostic Services are Covered?

The credit covers a wide range of diagnostic services, including MRI, CT scans, PET/CT scans, X-rays, ultrasounds, and mammography.

10.4 What are the Interest Rates and Fees?

Interest rates and fees vary based on creditworthiness and the specific terms of the credit agreement. It’s important to review these details before applying.

10.5 How Do I Make Payments?

Payments can typically be made online, via mail, or through automatic withdrawals. Setting up automatic payments can help ensure timely payments.

10.6 Can I Use the Credit at Any SDMI Location?

The credit can generally be used at any participating SDMI location. It’s best to confirm with the specific location beforehand.

10.7 What If I Have Trouble Making Payments?

Contact customer service as soon as possible to discuss potential options, such as a modified payment plan or temporary assistance.

10.8 Can I Prepay My Balance?

Many credit agreements allow for prepaying the balance without penalty. Review the terms and conditions to confirm.

10.9 How Does the Credit Affect My Credit Score?

Responsible use of the credit, including timely payments and keeping your balance low, can positively impact your credit score. Late payments and high balances can negatively affect your score.

10.10 What are the Alternatives to Using the Credit?

Alternatives include personal loans, medical credit cards, hospital financial assistance programs, and health savings accounts (HSAs).

Understanding Steinberg Diagnostic Care Credit can help you manage your healthcare costs effectively. At CAR-TOOL.EDU.VN, we are committed to providing you with the information you need to make informed decisions about your health and finances.

For more information or to explore additional resources, contact CAR-TOOL.EDU.VN at 456 Elm Street, Dallas, TX 75201, United States. You can also reach us via Whatsapp at +1 (641) 206-8880 or visit our website at CAR-TOOL.EDU.VN. Let us assist you in finding the best solutions for your needs.

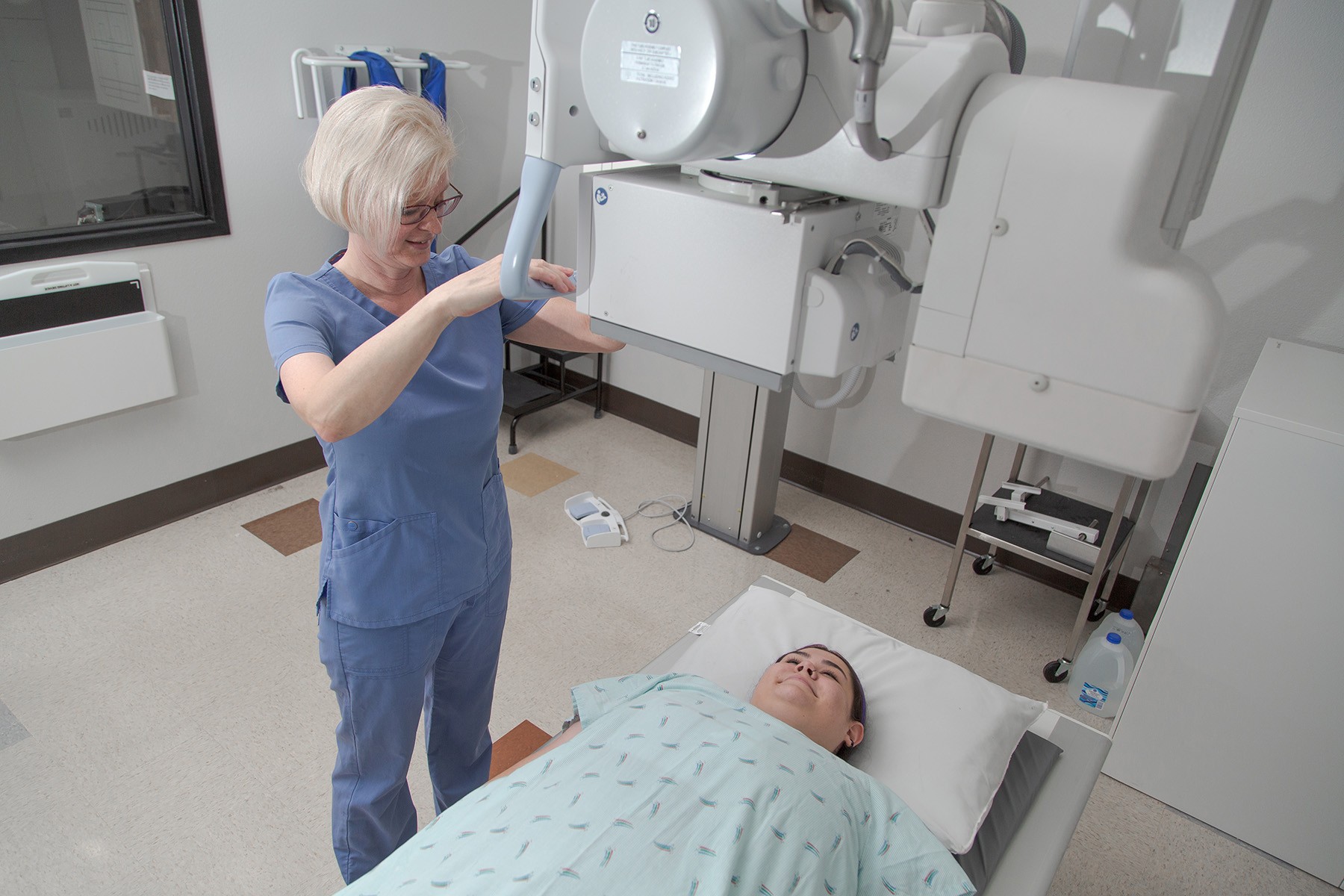

X-Ray Image

X-Ray Image

Contact CAR-TOOL.EDU.VN now via Whatsapp at +1 (641) 206-8880 for immediate assistance and expert advice! We’re here to help you navigate your options and ensure you receive the best possible care.