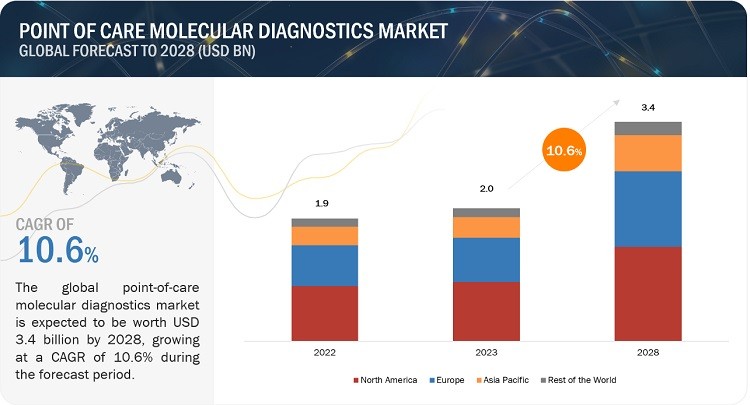

The Point Of Care Molecular Diagnostics Market is experiencing robust growth, projected to surge from USD 2.0 billion in 2023 to USD 3.4 billion by 2028, according to CAR-TOOL.EDU.VN’s analysis. This growth, fueled by a Compound Annual Growth Rate (CAGR) of 10.6%, stems from factors like the increasing prevalence of infectious diseases, advancements in healthcare infrastructure, and a growing emphasis on preventive medicine, signaling a transformative shift in diagnostic practices and healthcare accessibility, including enhanced medical testing and efficient disease management strategies. This growth is further amplified by innovations in diagnostic assays and the increasing adoption of point-of-care testing methodologies, underlining the importance of molecular diagnostic solutions in modern healthcare.

Contents

- 1. Understanding the Point of Care Molecular Diagnostics Market

- 2. Key Drivers of Market Growth

- 2.1. Rising Incidence of Infectious Diseases and Cancer

- 2.2. Advancements in Healthcare Infrastructure

- 2.3. Growing Emphasis on Preventive Medicine

- 2.4. Technological Advancements in Molecular Diagnostics

- 3. Restraints on Market Growth

- 3.1. Unfavorable Reimbursement Settings

- 3.2. Regulatory Hurdles

- 3.3. High Cost of Molecular Diagnostic Tests

- 3.4. Establishment of Alternative Technologies

- 4. Opportunities in Emerging Countries

- 4.1. Low Regulatory Barriers

- 4.2. Advancements in Healthcare Infrastructure

- 4.3. Expanding Patient Populations

- 4.4. Increasing Incidence of Infectious Diseases

- 4.5. Rise in Healthcare Expenditure

- 5. Segmentation of the Market

- 5.1. By Product & Service

- 5.2. By Technology

- 5.3. By Application

- 5.4. By End User

- 5.5. By Region

- 6. Regional Analysis

- 6.1. North America

- 6.2. Europe

- 6.3. Asia Pacific

- 7. Competitive Landscape

- 8. Recent Developments

- 9. Key Takeaways

- 10. Point of Care Molecular Diagnostics: A Comprehensive Guide

- 10.1. What is the expected growth rate of the global point of care molecular diagnostics market from 2023 to 2028?

- 10.2. What factors are driving the growth of the point of care molecular diagnostics market?

- 10.3. What challenges are faced by the point of care molecular diagnostics market?

- 10.4. What opportunities exist in emerging markets for the point of care molecular diagnostics industry?

- 10.5. Which product segment holds the largest market share in the point of care molecular diagnostics market?

- 10.6. What role does RT-PCR technology play in the point of care molecular diagnostics market?

- 10.7. Which region dominates the point of care molecular diagnostics market?

- 10.8. What is the impact of the increasing incidence of infectious diseases on the point of care molecular diagnostics market?

- 10.9. Which end-user segment accounted for the largest share of the point of care molecular diagnostics market in 2022?

- 10.10. What are the recent developments in the point of care molecular diagnostics market?

1. Understanding the Point of Care Molecular Diagnostics Market

What exactly is the point of care molecular diagnostics market, and why is it gaining so much traction? The point of care molecular diagnostics market focuses on diagnostic testing performed near or at the site of patient care, providing rapid results and enabling immediate clinical decision-making. This approach contrasts with traditional laboratory testing, which requires samples to be sent to a central lab, leading to longer turnaround times and potential delays in treatment.

Point-of-care diagnostics (POCD) offers several key advantages:

- Rapid Results: Results are available within minutes or hours, rather than days.

- Accessibility: Testing can be performed in a variety of settings, including clinics, hospitals, and even patients’ homes.

- Improved Patient Outcomes: Faster diagnosis leads to quicker treatment and better patient outcomes.

- Reduced Costs: POCD can reduce healthcare costs by minimizing hospital stays and follow-up visits.

As highlighted by a study from the National Institutes of Health (NIH) in 2023, POCD plays a crucial role in managing infectious diseases and chronic conditions by providing timely and accurate information to healthcare providers. The study noted a significant improvement in patient care and a reduction in healthcare costs associated with the use of point-of-care molecular diagnostics.

Point of Care Molecular Diagnostics Market

Point of Care Molecular Diagnostics Market

2. Key Drivers of Market Growth

What factors are propelling the expansion of the point of care molecular diagnostics market? Several key drivers are contributing to the market’s growth trajectory:

2.1. Rising Incidence of Infectious Diseases and Cancer

The escalating prevalence of infectious diseases such as influenza, respiratory syncytial virus (RSV), and sexually transmitted infections (STIs), as well as various forms of cancer, is a significant driver. Point-of-care molecular diagnostics enable rapid detection and diagnosis of these conditions, facilitating prompt treatment and preventing further spread. According to the World Health Organization (WHO), infectious diseases remain a leading cause of death worldwide, underscoring the need for effective diagnostic tools like POCD.

2.2. Advancements in Healthcare Infrastructure

Improvements in healthcare infrastructure, particularly in emerging economies, are expanding access to diagnostic testing. The establishment of more clinics, hospitals, and point-of-care testing centers is driving demand for molecular diagnostics solutions. A 2022 report by the World Bank emphasized the importance of investing in healthcare infrastructure to improve health outcomes and promote economic development, particularly in low- and middle-income countries.

2.3. Growing Emphasis on Preventive Medicine

With an increasing focus on preventive healthcare, individuals are seeking early detection and diagnosis of diseases. Point-of-care molecular diagnostics enable proactive screening and monitoring, empowering individuals to take control of their health and seek timely medical intervention. The Centers for Disease Control and Prevention (CDC) promotes preventive healthcare measures, including regular screenings and vaccinations, to reduce the burden of chronic diseases and improve overall health outcomes.

2.4. Technological Advancements in Molecular Diagnostics

Continuous advancements in molecular diagnostics technologies are enhancing the accuracy, speed, and ease of use of point-of-care testing. Innovations such as multiplex assays, which can detect multiple pathogens simultaneously, and miniaturized devices are further driving market growth. A study published in the journal Nature Biotechnology in 2023 highlighted the potential of microfluidic devices for point-of-care molecular diagnostics, noting their ability to perform complex assays with minimal sample volume and rapid turnaround times.

3. Restraints on Market Growth

What challenges are hindering the point of care molecular diagnostics market? Despite the promising growth prospects, several factors are restraining the market’s expansion:

3.1. Unfavorable Reimbursement Settings

Inadequate reimbursement policies for molecular diagnostic tests pose a significant challenge. Diagnostic companies often struggle to obtain sufficient payment from Medicare and private health insurers, particularly for novel tests lacking specific coding and coverage. The American Clinical Laboratory Association (ACLA) has been advocating for fair reimbursement policies to ensure access to innovative diagnostic technologies.

3.2. Regulatory Hurdles

Complex and stringent regulatory requirements for diagnostic devices can delay market entry and increase development costs. Manufacturers must navigate a complex landscape of regulations, including those set by the Food and Drug Administration (FDA) in the United States and the European Medicines Agency (EMA) in Europe. The FDA’s premarket approval (PMA) process for high-risk diagnostic devices can be particularly lengthy and costly.

3.3. High Cost of Molecular Diagnostic Tests

The relatively high cost of molecular diagnostic tests compared to traditional methods can limit their adoption, especially in resource-constrained settings. The cost of reagents, instruments, and trained personnel can be prohibitive for some healthcare providers and patients. The Foundation for Innovative New Diagnostics (FIND) is working to develop and promote affordable diagnostic solutions for low- and middle-income countries.

3.4. Establishment of Alternative Technologies

The emergence of alternative technologies, such as rapid antigen tests, presents a potential obstacle to the growth of the molecular diagnostics market. Antigen tests are often cheaper and faster to manufacture, making them attractive options for certain applications, such as COVID-19 testing. However, molecular tests generally offer higher sensitivity and specificity, making them more reliable for accurate diagnosis.

4. Opportunities in Emerging Countries

What opportunities exist for the point of care molecular diagnostics market in emerging economies? Emerging countries such as India, South Korea, Brazil, and Mexico offer substantial growth prospects for players in the market. These opportunities stem from several factors:

4.1. Low Regulatory Barriers

Relatively low regulatory barriers in some emerging countries facilitate faster market entry for diagnostic companies. Regulatory policies may be more flexible and conducive to business compared to those in developed nations, allowing companies to introduce new products and technologies more quickly.

4.2. Advancements in Healthcare Infrastructure

Investments in healthcare infrastructure are expanding access to diagnostic testing in emerging economies. The construction of new clinics, hospitals, and diagnostic centers is driving demand for molecular diagnostics solutions. Governments in these countries are increasingly recognizing the importance of healthcare infrastructure for improving health outcomes and promoting economic development.

4.3. Expanding Patient Populations

Growing patient populations, particularly in urban areas, are increasing the demand for diagnostic services. As more people gain access to healthcare, the need for rapid and accurate diagnostic testing is rising. The United Nations Population Fund (UNFPA) projects that the world’s population will continue to grow, with the majority of growth occurring in developing countries.

4.4. Increasing Incidence of Infectious Diseases

High prevalence rates of infectious diseases in emerging countries drive demand for point-of-care molecular diagnostics. Rapid and accurate diagnosis is essential for controlling outbreaks and preventing the spread of diseases such as tuberculosis, HIV, and malaria. The Global Fund to Fight AIDS, Tuberculosis and Malaria supports efforts to strengthen diagnostic capacity in countries with high burdens of these diseases.

4.5. Rise in Healthcare Expenditure

Increasing healthcare expenditure in emerging economies is creating opportunities for diagnostic companies. As governments and individuals invest more in healthcare, the demand for advanced diagnostic technologies is rising. The World Bank projects that healthcare spending will continue to increase in emerging countries, driven by economic growth and rising incomes.

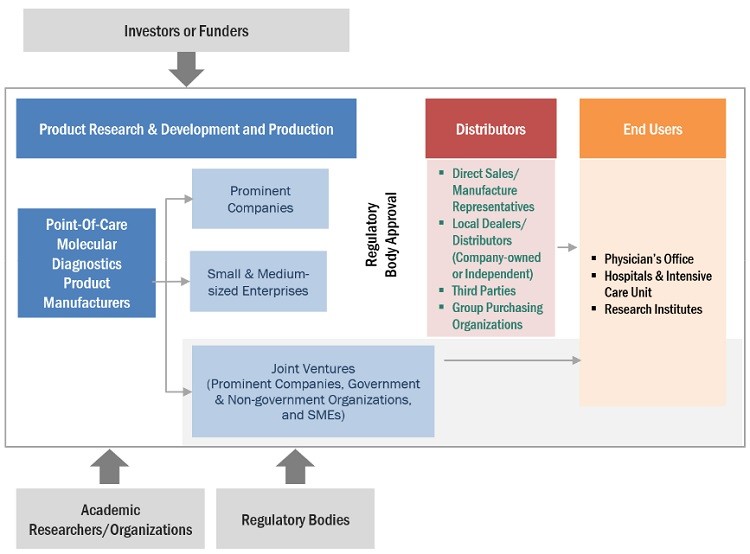

Point of Care Molecular Diagnostics Market Ecosystem

Point of Care Molecular Diagnostics Market Ecosystem

5. Segmentation of the Market

How is the point of care molecular diagnostics market segmented? The market can be segmented based on product & service, technology, application, end user, and region.

5.1. By Product & Service

- Assays & Kits: These are reagents and consumables used in molecular diagnostic tests. The assays & kits segment accounted for the largest share of the market in 2022, driven by the frequent purchase of these products due to their recurrent usage.

- Instruments & Analyzers: These are devices used to perform molecular diagnostic tests.

- Software & Services: These include software and services related to molecular diagnostics, such as data analysis and consulting.

5.2. By Technology

- RT-PCR: Reverse transcription polymerase chain reaction (RT-PCR) is a widely used technology for detecting and quantifying RNA viruses. The RT-PCR segment accounted for the largest share of the market in 2022, due to its ease of use, cost-effectiveness, and rapid turnaround time.

- INAAT: Isothermal nucleic acid amplification technology (INAAT) is another technology used for molecular diagnostics.

- Other Technologies: Other technologies include microarrays, next-generation sequencing (NGS), and loop-mediated isothermal amplification (LAMP).

5.3. By Application

- Respiratory Diseases: This includes influenza, RSV, and other respiratory infections.

- Sexually Transmitted Diseases: This includes chlamydia, gonorrhea, and HIV.

- Hospital-Acquired Infections: This includes MRSA and C. difficile.

- Cancer: This includes various types of cancer, such as lung cancer and breast cancer.

- Hepatitis: This includes hepatitis B and hepatitis C.

- Gastrointestinal Disorders: This includes C. difficile and other gastrointestinal infections.

- Other Applications: This includes genetic testing and prenatal screening.

5.4. By End User

- Physicians’ Offices: Point-of-care molecular assays & kits and systems are extensively used in physicians’ offices as they provide quick results within 30 minutes, facilitating instant diagnosis and monitoring of patient conditions.

- Hospitals & ICUs: Hospitals and intensive care units (ICUs) are major end users of molecular diagnostics.

- Research Institutes: Research institutes use molecular diagnostics for research purposes.

- Other End Users: Other end users include home healthcare settings and public health laboratories.

5.5. By Region

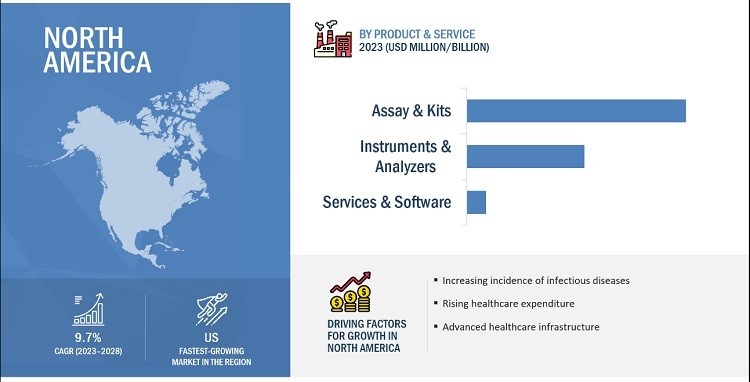

- North America: North America accounted for the largest share of the global market in 2022, driven by the high burden of infectious diseases and cancers, well-developed healthcare infrastructure, and growing adoption of advanced technologies for infectious disease testing.

- US

- Canada

- Europe:

- UK

- Germany

- France

- Italy

- Rest of Europe (RoE)

- Asia Pacific:

- China

- Japan

- India

- Rest of Asia Pacific (RoAPAC)

- Latin America

- Middle East & Africa

Point of Care Molecular Diagnostics Market by Region

Point of Care Molecular Diagnostics Market by Region

6. Regional Analysis

Which regions are dominating the point of care molecular diagnostics market? North America is the largest region of the point of care molecular diagnostics market, followed by Europe and Asia Pacific.

6.1. North America

The high burden of infectious diseases and cancers on regional healthcare systems is one of the major drivers for market growth in North America. Furthermore, the presence of a well-developed healthcare infrastructure and the growing adoption of advanced technologies for infectious disease testing are other factors anticipated to support the growth of the market in the region. According to the CDC, infectious diseases are a leading cause of death and disability in the United States, underscoring the need for effective diagnostic tools.

6.2. Europe

Europe is the second-largest region in the point of care molecular diagnostics market. The market in Europe is driven by the increasing prevalence of infectious diseases, aging population, and growing adoption of point-of-care testing. The European Centre for Disease Prevention and Control (ECDC) monitors the spread of infectious diseases in Europe and provides guidance on prevention and control measures.

6.3. Asia Pacific

Asia Pacific is the fastest-growing region in the point of care molecular diagnostics market. The market in Asia Pacific is driven by the expanding patient populations, improving healthcare infrastructure, and increasing prevalence of infectious diseases. Countries such as China and India are investing heavily in healthcare infrastructure to improve access to diagnostic testing.

7. Competitive Landscape

Who are the key players in the point of care molecular diagnostics market? The major players in this market include:

- Abbott Laboratories (US)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- bioMérieux SA (France)

- Danaher Corporation (US)

- QIAGEN N.V. (Netherlands)

These players lead the market because of their extensive product portfolios and wide geographic presence. These dominant market players also have numerous advantages, such as more robust marketing and distribution networks, larger budgets for R&D, and better brand recognition. These companies are continuously innovating and launching new products to maintain their competitive edge.

8. Recent Developments

What are the recent developments in the point of care molecular diagnostics market?

- April 2023: QIAGEN N.V. (Netherlands) launched QIAstat-Dx in Japan with a respiratory panel for syndromic testing.

- June 2022: Biocartis NV (Belgium) launched the Rapid CE-marked IVD Idylla GeneFusion Panel for fast treatment decisions in lung cancer.

- May 2022: bioMérieux SA (France) received De Novo FDA Authorization for its BIOFIRE Joint Infection (JI) Panel.

- September 2021: F. Hoffmann-La Roche Ltd. (Switzerland) acquired TIB Molbiol (Germany) to expand its PCR test portfolio with a wide range of assays for infectious diseases.

These developments highlight the ongoing innovation and expansion in the point of care molecular diagnostics market. Companies are focusing on developing new assays and panels to address a wide range of diseases and conditions.

9. Key Takeaways

- The point of care molecular diagnostics market is experiencing robust growth, driven by the rising incidence of infectious diseases, advancements in healthcare infrastructure, and a growing emphasis on preventive medicine.

- The market faces challenges such as unfavorable reimbursement settings, regulatory hurdles, and the high cost of molecular diagnostic tests.

- Emerging countries offer substantial growth prospects for players in the market due to low regulatory barriers, advancements in healthcare infrastructure, expanding patient populations, increasing incidence of infectious diseases, and a rise in healthcare expenditure.

- The market is segmented based on product & service, technology, application, end user, and region.

- North America is the largest region of the point of care molecular diagnostics market, followed by Europe and Asia Pacific.

- The major players in this market include Abbott Laboratories, F. Hoffmann-La Roche Ltd., bioMérieux SA, Danaher Corporation, and QIAGEN N.V.

- Recent developments include the launch of new assays and panels by QIAGEN, Biocartis, and bioMérieux, as well as the acquisition of TIB Molbiol by F. Hoffmann-La Roche Ltd.

10. Point of Care Molecular Diagnostics: A Comprehensive Guide

Do you have questions about point of care molecular diagnostics? Let’s address some frequently asked questions:

10.1. What is the expected growth rate of the global point of care molecular diagnostics market from 2023 to 2028?

The global point of care molecular diagnostics market is projected to grow from USD 2.0 billion in 2023 to USD 3.4 billion by 2028, at a CAGR of 10.6%, driven by the rising incidence of infectious diseases and the increasing focus on healthcare infrastructure improvement. The market’s growth is closely linked to advancements in medical technology, enabling more effective diagnostic solutions at the point of care.

10.2. What factors are driving the growth of the point of care molecular diagnostics market?

The major drivers of the point of care molecular diagnostics market include the growing incidence of infectious diseases and cancer, advancements in healthcare infrastructure, and the increasing preference for preventive medicine. These factors collectively contribute to the rising demand for quick and accurate diagnostic solutions that can be deployed at the point of care, improving patient outcomes and reducing healthcare costs.

10.3. What challenges are faced by the point of care molecular diagnostics market?

One of the main challenges for the point of care molecular diagnostics market is unfavorable reimbursement settings, along with the availability of alternative diagnostic technologies such as antigen tests, which can be cheaper and faster. Overcoming these challenges will require advocacy for fair reimbursement policies and continued innovation in molecular diagnostic technologies to improve their cost-effectiveness and accessibility.

10.4. What opportunities exist in emerging markets for the point of care molecular diagnostics industry?

Emerging economies such as India, South Korea, Brazil, and Mexico offer significant growth opportunities due to their expanding patient populations, improving healthcare infrastructure, and increasing prevalence of infectious diseases. These markets represent untapped potential for diagnostic companies to expand their reach and contribute to improving healthcare outcomes in underserved regions.

10.5. Which product segment holds the largest market share in the point of care molecular diagnostics market?

The assays and kits segment held the largest share of the point of care molecular diagnostics market in 2022, driven by the frequent and recurrent usage of these products for diagnostic purposes. This reflects the ongoing need for reliable and high-quality reagents to support molecular diagnostic testing at the point of care.

10.6. What role does RT-PCR technology play in the point of care molecular diagnostics market?

RT-PCR technology accounts for the largest share in the point of care molecular diagnostics market due to its widespread use, cost-effectiveness, and rapid turnaround time in diagnosing various diseases. Its ability to quickly detect and quantify RNA viruses makes it an essential tool in the fight against infectious diseases.

10.7. Which region dominates the point of care molecular diagnostics market?

North America holds the largest share of the point of care molecular diagnostics market, driven by a high incidence of infectious diseases, advanced healthcare infrastructure, and the growing adoption of molecular diagnostic technologies. The region’s commitment to innovation and healthcare quality makes it a leader in the adoption of point-of-care diagnostics.

10.8. What is the impact of the increasing incidence of infectious diseases on the point of care molecular diagnostics market?

The growing incidence of infectious diseases is a key driver of demand for point of care molecular diagnostics, particularly in respiratory and sexually transmitted diseases, contributing to market expansion. The ability to quickly and accurately diagnose these diseases at the point of care is crucial for controlling outbreaks and improving patient outcomes.

10.9. Which end-user segment accounted for the largest share of the point of care molecular diagnostics market in 2022?

In 2022, physicians’ offices held the largest share of the market due to the widespread use of point of care molecular diagnostics for quick and efficient patient diagnosis in a clinical setting. The convenience and speed of point-of-care testing in physicians’ offices make it an attractive option for both healthcare providers and patients.

10.10. What are the recent developments in the point of care molecular diagnostics market?

Recent developments include QIAGEN’s launch of QIAstat-Dx in Japan for syndromic testing and bioMérieux’s FDA authorization for its BIOFIRE Joint Infection Panel. These advancements highlight the ongoing innovation and expansion in the market, with companies focusing on developing new assays and panels to address a wide range of diseases and conditions.

Searching for reliable information on the point of care molecular diagnostics market? CAR-TOOL.EDU.VN provides comprehensive resources and expert insights to help you stay informed. Contact us today to learn more and discover how we can assist you with your diagnostic needs.

For more in-depth information and consultations regarding automotive tools and diagnostics, reach out to us at:

Address: 456 Elm Street, Dallas, TX 75201, United States

WhatsApp: +1 (641) 206-8880

Website: CAR-TOOL.EDU.VN

We are here to help you navigate the world of automotive diagnostics and repair with confidence.